The Net Present Value of Content

In order to reflect on the value of content (audio, video, images, text), we’ll take a short tutorial in how to estimate the value of a business.

Too impatient? Jump to estimating the value of content.

The Value of a Business

The concept of “net-present value” is at the center of global finance.

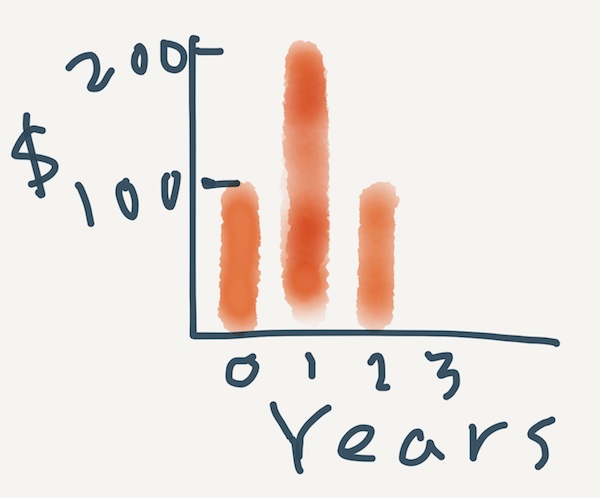

Imagine that you have a business that makes these revenues over 4 years:

| Year | Revenue | Years in Business |

|---|---|---|

| 2017 | $100 | 0 |

| 2018 | $200 | 1 |

| 2019 | $100 | 2 |

| 2020 | $0 | 3 |

Why no more revenues in 2020? Let’s say we go out of business in the 4th year :)

All businesses’ revenues eventually go to zero as markets trend towards perfect competition over time.

If I asked you how much our company is worth you might say “this is easy: $100 + $200 + $100 = $400–our business should be worth $400!”

It’s not that simple :)

The catch is that the value of $100 in 2 years from now is less than the value of possessing $100 today.

What if you had $100 today and were able to lend it to someone at a non-zero, positve rate of interest (let’s say 1% per year)?

That $100 in 2 years from now would be more than $100:

$100.00 * 1.01 * 1.01 = $102.01

The math works in reverse as well, by dividing the numbers from the amount of money we make in a future year ($100 in 2019):

$100.00 (in 2019) / (1.01 ^ (2019 - 2017)) = $100 / (1.01 x 1.01) = $98.03

$98.03 is what is called the net-present value of $100 in 2019, assuming an interest rate of 1%.

So a crude financial model to value the business off of the net-present value of its future revenues would be:

$100

$200 / 1.01

$100 / (1.01^2)

= $396.05

As you can imagine, that 1% interest rate is imporant–it has a huge effect on our estimate of the business’s value!

Consider if we could lend our $100 we make in 2017 at a 3% interest rate instead of 1%:

$100.00 * 1.03 * 1.03 = $106.09

While we’ve estimated the value of a fictional business, this methodology is used in reality–by Goldman Sachs, JP Morgan Chase.

It’s even used by executives at tech companies who are seeking to sell their businesses and cash out for the big bucks!

The Value of Content

The value of a business is a lot like the value of a piece of content.

Two reasons:

- the number of times that a piece of content is seen or listened to is roughly proportional to the revenue of a business

- like a business whose revenue goes to zero, the views that our YouTube video gets will eventually go to zero over time

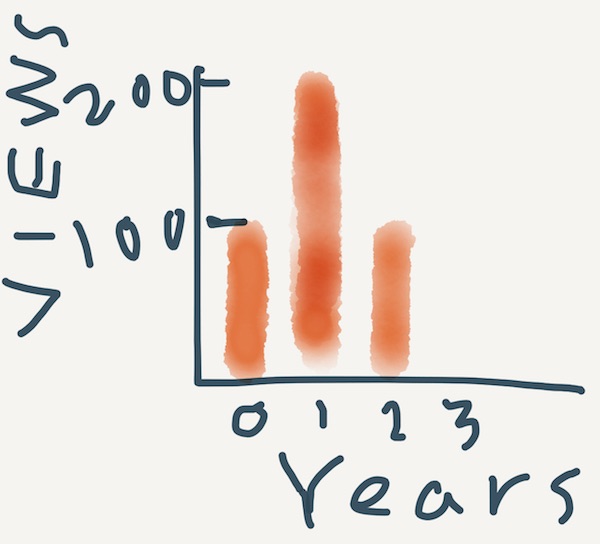

To illustrate, we might have a YouTube video with the following forecasted number of views:

| Year | Views | Time Delta (years) |

|---|---|---|

| 2017 | 1,000 | 0 |

| 2018 | 2,000 | 1 |

| 2019 | 1,000 | 2 |

| 2020 | 0 | 3 |

So how do we determine the “interest rate” at which we can “lend out” an impression today versus an impression two years from now?

Great question–I’m not sure.

But I’d conservatively estimate that the interest rate of content is as high as 50% per year–with the advent of the internet people’s attention has become a finite commodity and we are in the midst of a massive landgrab for brand awareness.

Adopting my estimated interest rate for the sake of though experiment we can estimate the value of making and publishing your video today:

1000

2000 / 1.50

1000 / (1.50^2)

2777 views

However if you were to wait a year to publish your video, the net-present value of those 4000 views would be:

1000 / 1.50

2000 / (1.50^2

1000 / (1.50^3)

1851 views

That’s 2777 - 1851 = 926 views or 33% less views in terms of the net-present value of those views!

My point is…get off your ass and publish your content!

You will be leaving your competitors in the dust, and by churning out content you’ll start down the road to learning what is good content!

Improving the quality of your content will increase the number of views your content receives over its lifetime–which pays even more dividends by virtue of the net-present value of those views.

And if you have any ideas about how to estimate the interest rate of content, please get in touch!

Interested?

We’re working on these hard problems–come and help us make videos for software engineers!

Enjoyed this post? Get new posts via email